Just sell the idea that they are not being sold to

Source: BoJack Horseman wiki

In “The Amelia Earhart Story” episode of BoJack Horseman, Princess Carolyn (PC) is trying to convince Sadie that she is the right person to adopt her baby. Sadie is having some trouble with sales at the flea market. “Everyone’s browsin’ but no one’s buyin’” she says. PC steps up. She is an agent at Hollywoo after all, and selling is what she lives and breathes. A flea has eyes on a jacket. PC goes to the flea and tells him that he can’t have it since she laid her eyes on it first. And the flea says I am going to buy it before you do. And he does. “You can sell anything if you just sell the idea that they are not being sold to,” PC concludes.

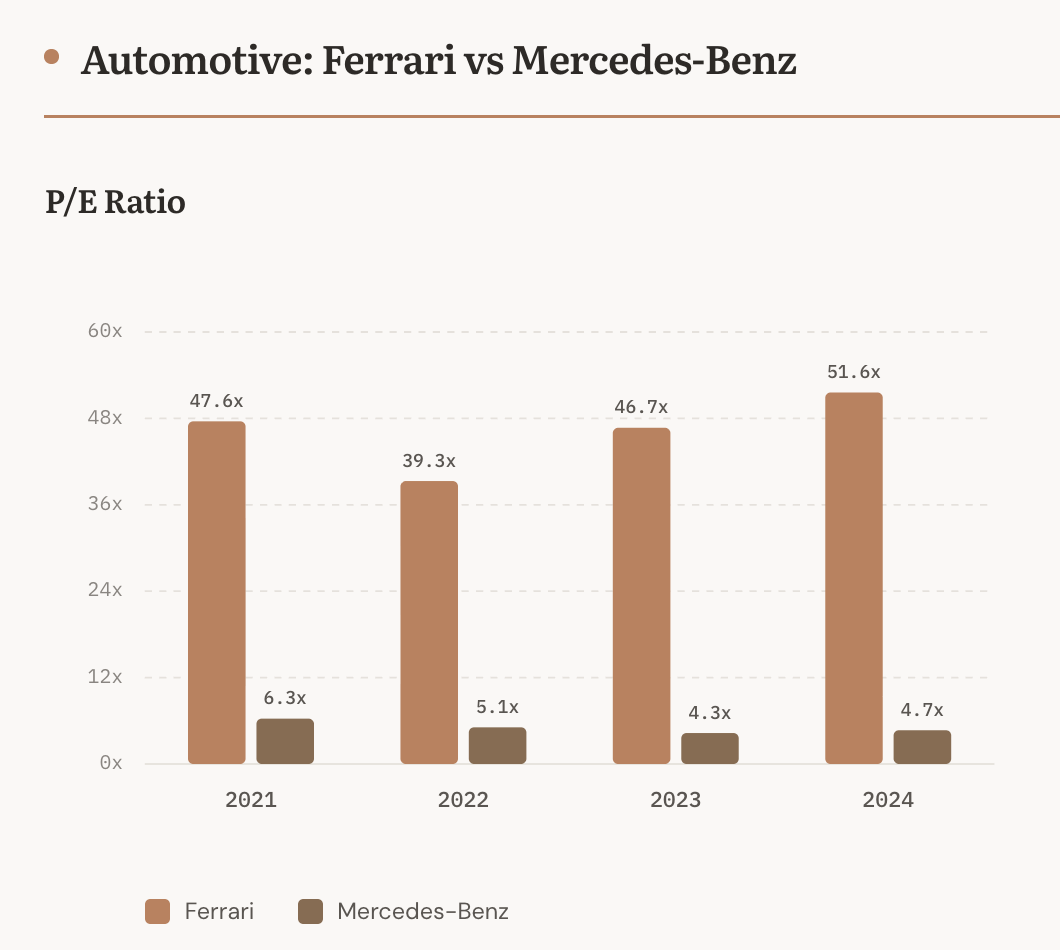

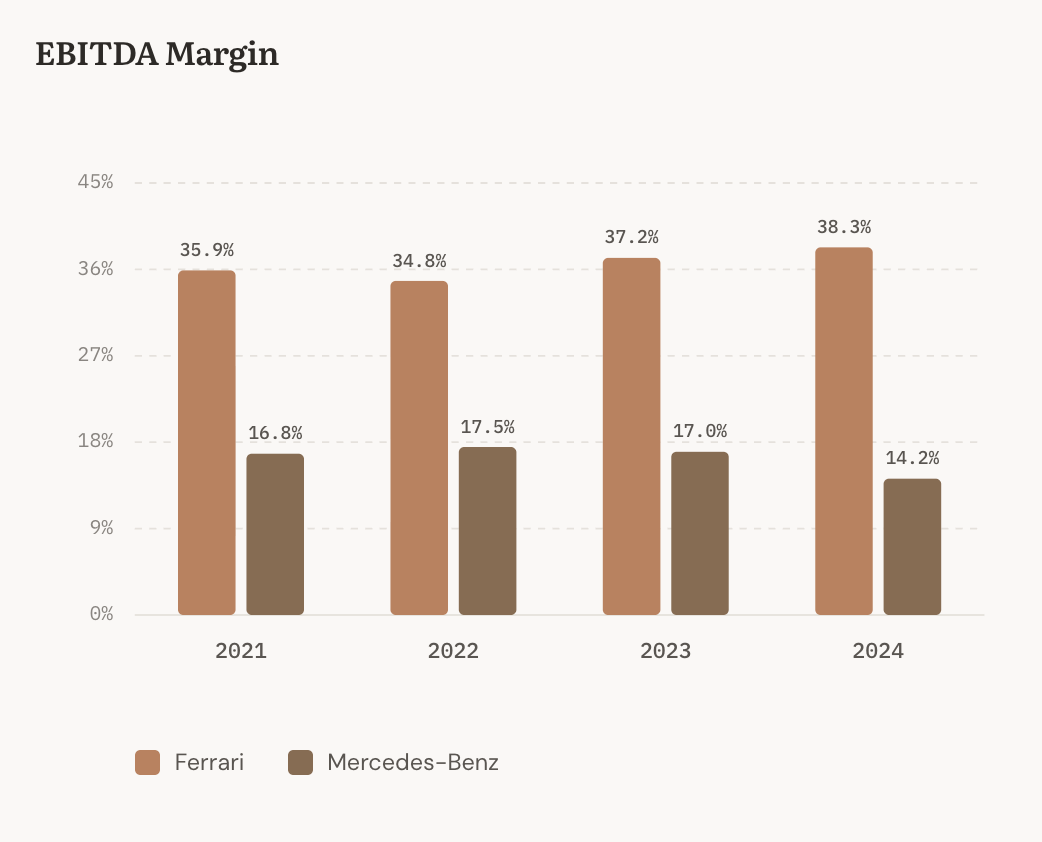

Ferrari does something similar. And so does Hermès. Enzo Ferrari famously said something along these lines: “Manufacture one car less than what the market demands.” And Ferrari truly does that. Ferrari has successfully created a need and a craving among the ultra rich for the car. They are never sold to. The script is flipped. The ultra rich have to make a case for why they are worthy of owning one. Over three-quarters of sales go to existing customers, many of whom already own multiple Ferraris. Mercedes has been trying really hard to command a multiple like Ferrari’s, but it hasn’t been successful.

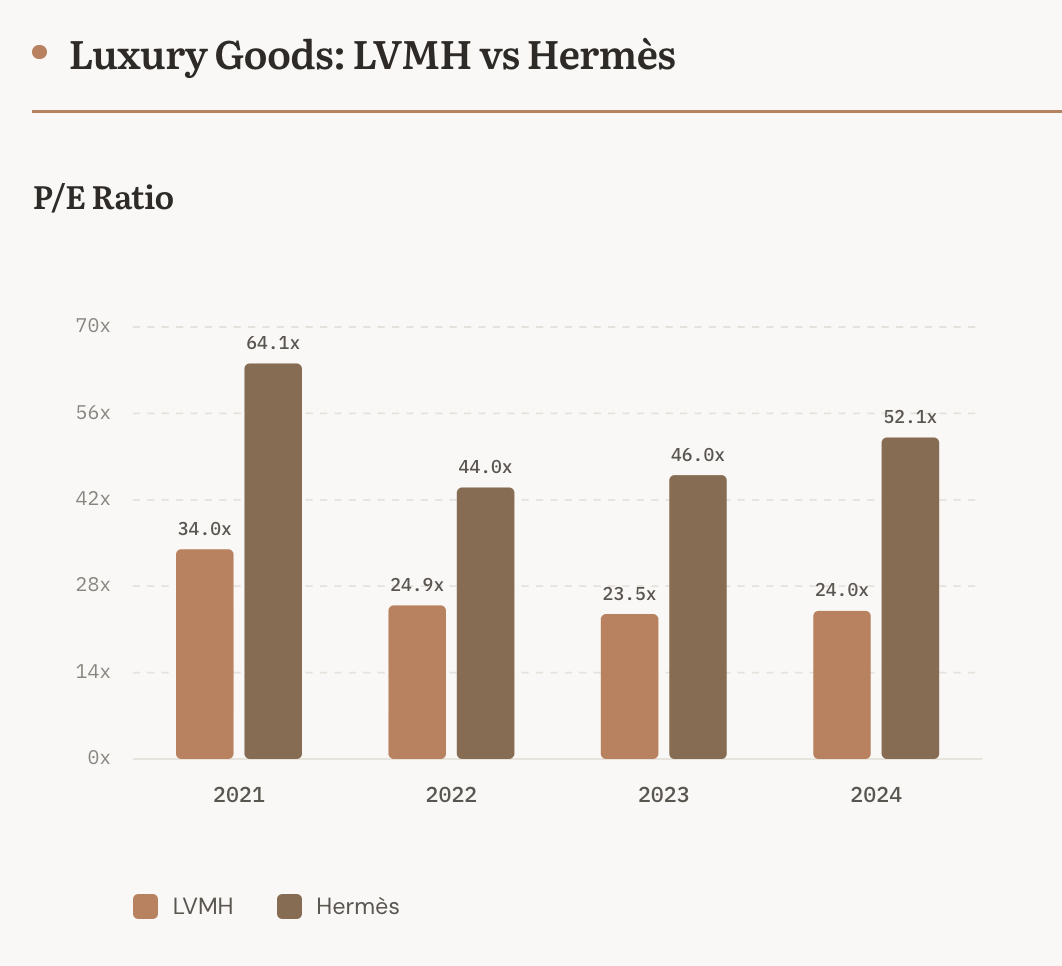

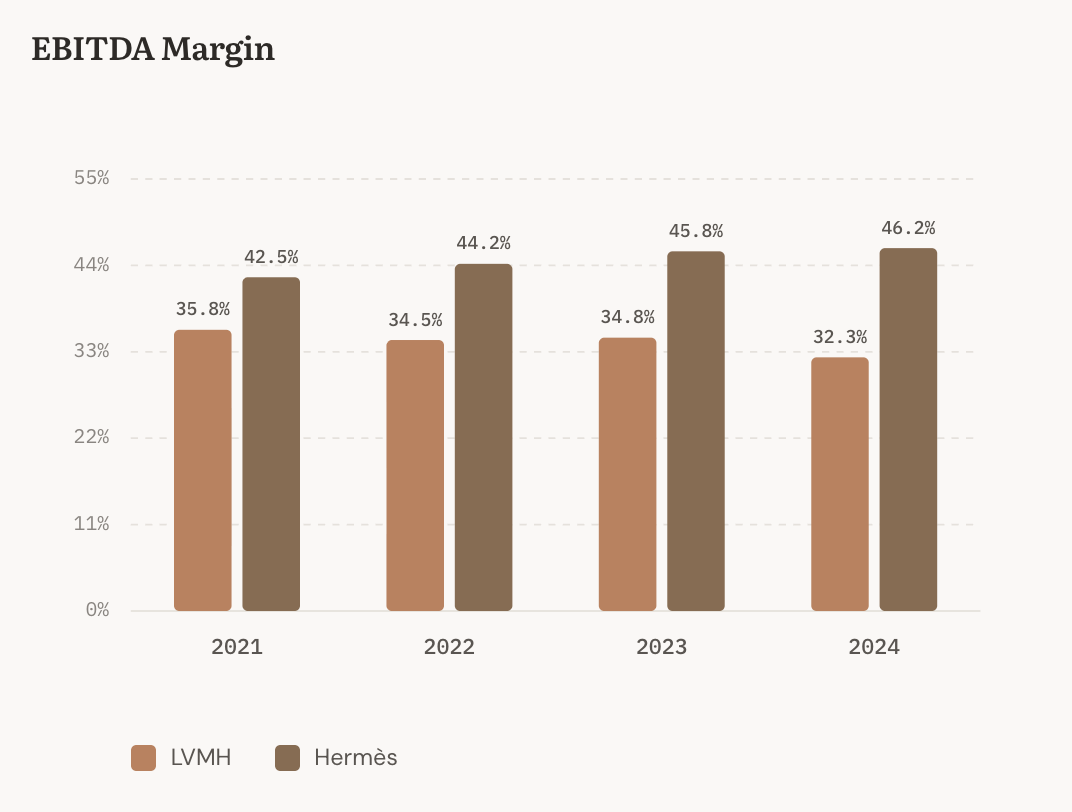

Hermès plays the same game. You cannot walk into a store and buy a Birkin. You place an order, join a queue, and wait. Sometimes for years. The bag is not being sold to you. A Birkin starts at around €10,000 in Paris but commands double or triple that on the resale market. By maintaining scarcity, Hermes commands a stunning price to earnings ratio compared to LVMH, the luxury conglomerate that has not maintained enough scarcity and once tried to to buy out Hermès.

Here’s a comparison of their profitability and P/E ratios. A high P/E suggests that investors expect strong future growth, or value the stock more.

Source: Company filings, financial databases · Data as of fiscal year-end

The idea of not being sold to is useful in FBI negotiations too. The legendary FBI negotiator, Chriss Voss explains how traditional sales techniques don’t work. For instance, you might have heard about “Geting the customer to a yes”.

But the moment you get the user to say yes (sometimes, deceptively), you are taking away their control. If someone stops you on the street and asks “Do you care about hungry children?” You know they are trying to get a donation out of you. You know you are being sold to.

According to Voss, the first thing he did at every hostage negotiation was to get the criminal to say no. Not a yes. A no. Because that is what helps them feel in charge, and in control. Instead of saying “Do you want to come out safely?”, he might say, “Are you against finding a way for this to end without anyone getting hurt?”. Criminal says “No.”

Many of us have probably used “Is this a bad time to talk?” instead of “Good time to talk?”. You can guess which one Voss would prefer!

I unintentionally tested the power of no while changing the onboarding funnel for a mental wellness app. I was setting up an experiment to boost my sign up rates. This is how I imagined things would go. Do you want mindful healthy habits —> User clicks yes —> Do you want to achieve calmness —> User clicks yes —> Then sign up to get calmness. Boom the user signs up and my numbers would go up. But the sign up numbers tanked. I had to stop the experiment ASAP. When we eventually gave users more control over their onboarding, showing them how their data was being used and letting them choose between signing up with their company account or their individual account, the numbers went up.

Turns out Princess Carolyn, Chris Voss, Ferrari, and Hermès all understood something that many people and curricula miss: People don’t want to be sold to. They love to feel in control.